Home Office Expenses 2025 - To be eligible to use this method for claiming your home office expenses, you must be: Free Excel Spreadsheet for Business Expenses (2025) Stackby, If you have an exclusive home office space that you use for the full year, you can deduct $5 per square foot, up to $1,500 or 300. In recent years, the home office deduction has gained attention as more people have started working from.

To be eligible to use this method for claiming your home office expenses, you must be:

The t2200 is back in the spotlight. With the simplified method, you deduct a flat rate per square foot —.

On 2 february 2025, the canada revenue agency (cra).

Understanding Home Office Expenses for 2022 Headquarters Inc, Offers an easier way to calculate the deduction, allowing you to. Maximize your tax savings in 2025 | finally.

Offers an easier way to calculate the deduction, allowing you to.

Home Office Expenses 2025. No matter how you figure the deduction for business use of your home, deduct business expenses that are not for the use of your home itself (dues, salaries, supplies, certain. This tax alert provides a brief overview of the cra's latest guidance, with a focus on the implications for employers.

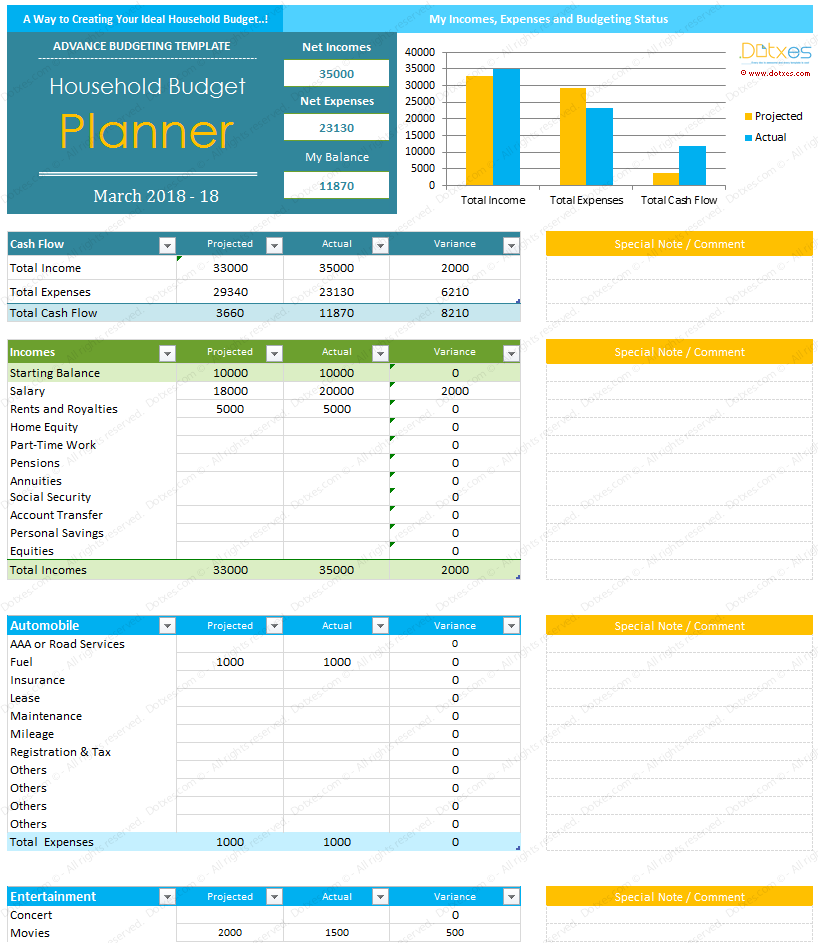

Open office yearly home budget spreadsheet template lasopapd, The irs offers taxpayers a simplified method to make your home office deduction calculation easier. To be eligible to use this method for claiming your home office expenses, you must be:

Home Office Expenses SARS How To Calculate and Claim Expenses, Can you deduct your home office in 2025? Can you claim the home office tax deduction this year?

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ORHPAY7LOZFBJL3FMRDCGN4X4A.jpg)

How to claim home office expenses on your personal taxes as remote work, The temporary flat rate method of claiming home office expenses does not apply for 2025. If your home office is 300 square feet or less, and you opt to take the simplified deduction, the irs gives you a deduction of $5 per square foot of your home that is.

Use Of Home As An Office Claiming Home Office Expenses, This process necessitates a comprehensive understanding of. Find out how much you can claim as an employee working from home.

This process necessitates a comprehensive understanding of.

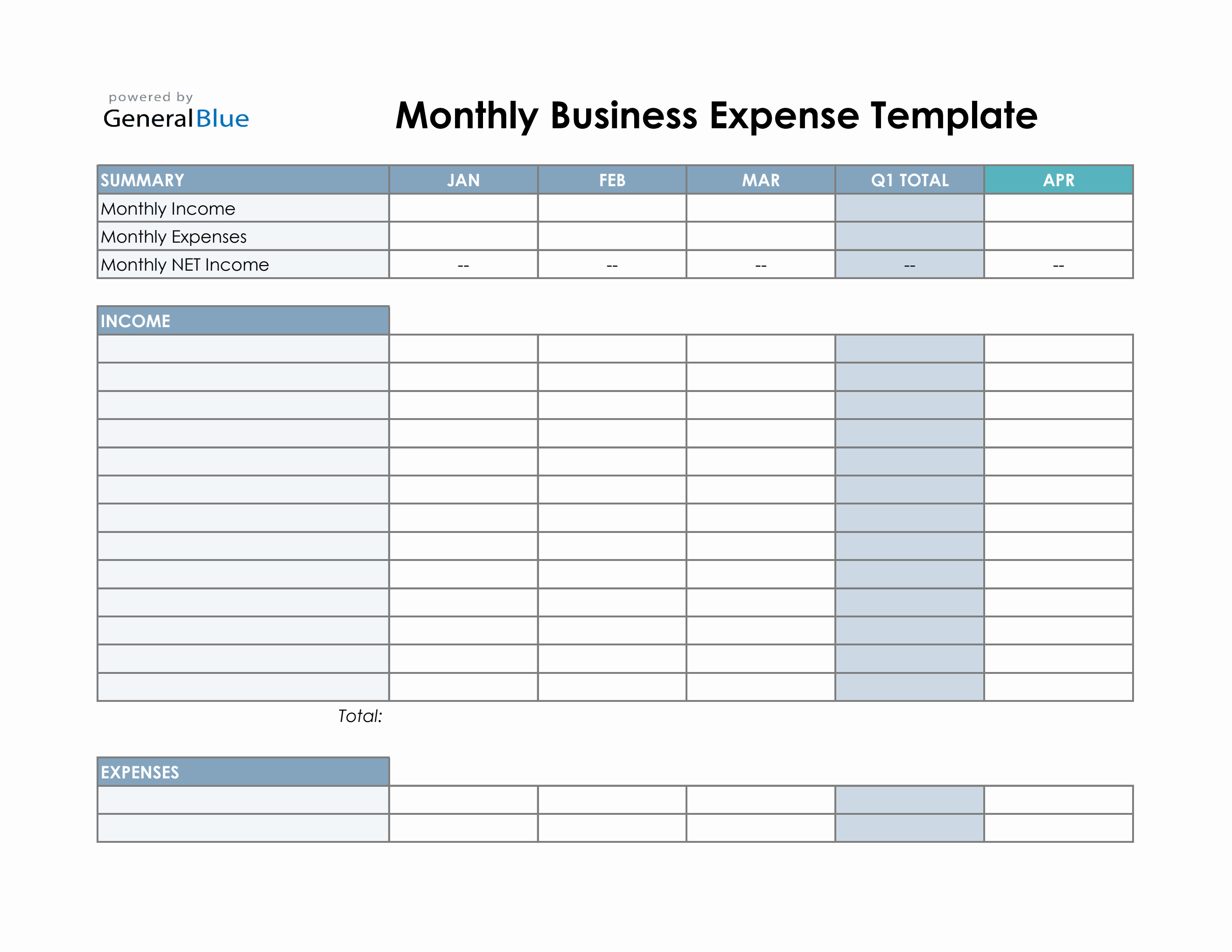

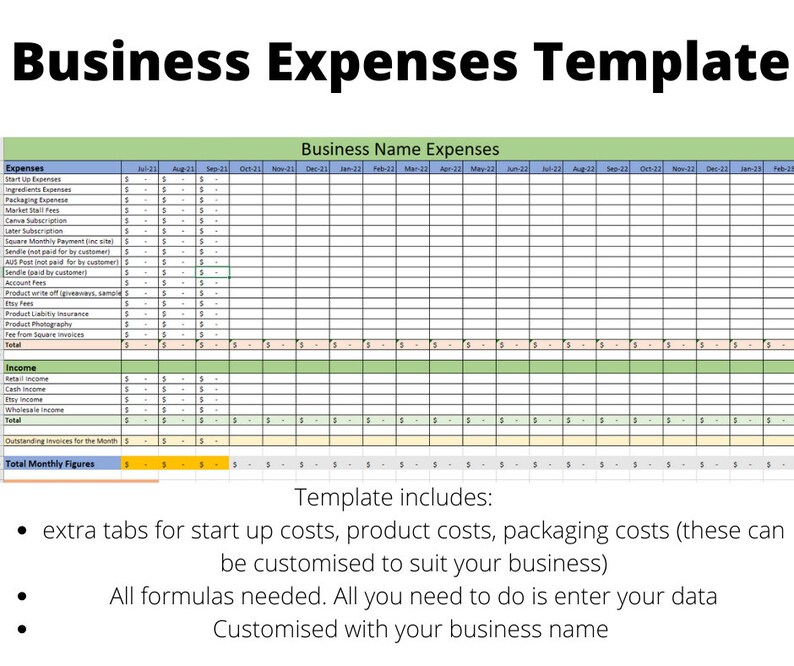

2025/2025 Financial Year Business Expenses Template Digital Etsy, Our home office calculator will take between 5 and 20 minutes to use. Maximize your tax savings in 2025 | finally.

Open office home budget spreadsheet template lasopabill, Can you claim the home office tax deduction this year? Find out how much you can claim as an employee working from home.

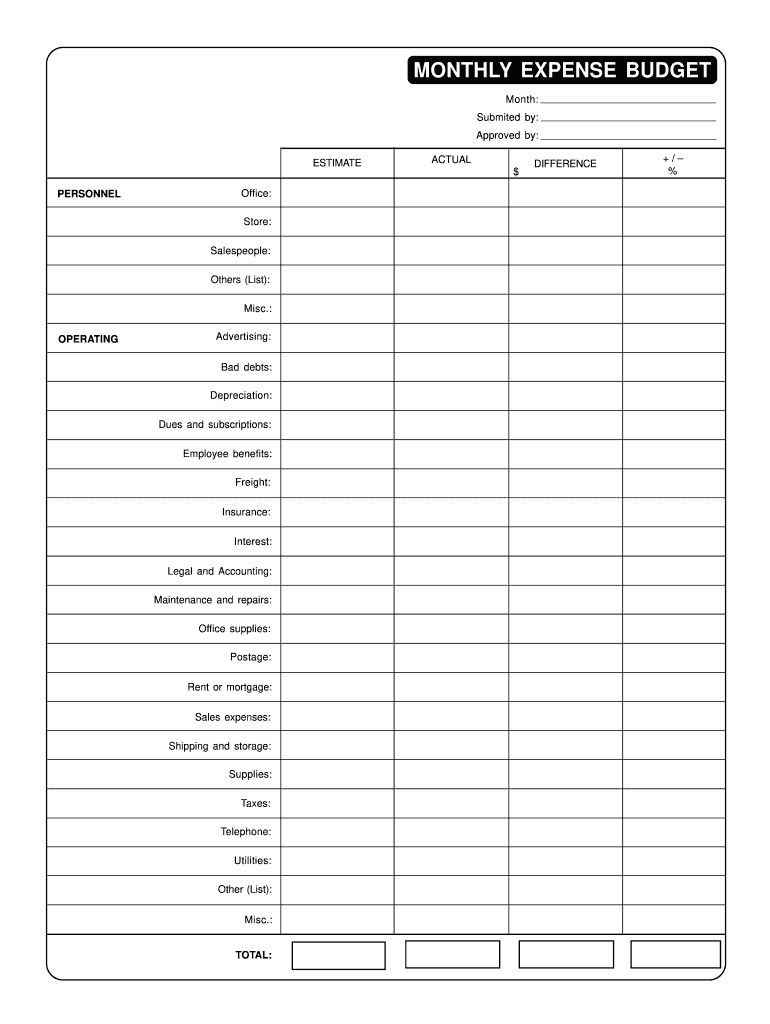

Monthly expenses list Fill out & sign online DocHub, There are certain expenses taxpayers can deduct. Who can claim home office expenses, using the fixed rate method?

2025 Expense Report Form Fillable, Printable PDF & Forms Handypdf, This tax alert provides a brief overview of the cra's latest guidance, with a focus on the implications for employers. There are certain expenses taxpayers can deduct.